If you want to know what companies really care about when it comes to cloud and multi-cloud, it helps to pay attention to how they’re actually spending their cash. According to the inaugural HashiCorp State of Cloud Strategy Survey, companies are investing big money in their multi-cloud efforts — but not always in the ways you might expect.

For example, while just over half of the survey’s 3,200+ respondents said cost was a primary cloud inhibitor, more than a quarter cited potential cost savings as a driver of cloud adoption. But while only 42% of financial services companies voiced cloud cost concerns, 60% of entertainment and media respondents did so. Cloud budgets also varied by industry and location. A third of software and services companies spent less than $100,000 a year on the cloud, while more a quarter (27%) of telcos spent more than $10 million a year. Respondents from North America were the biggest cloud spenders, with 40% dropping more than $2 million a year on the cloud.

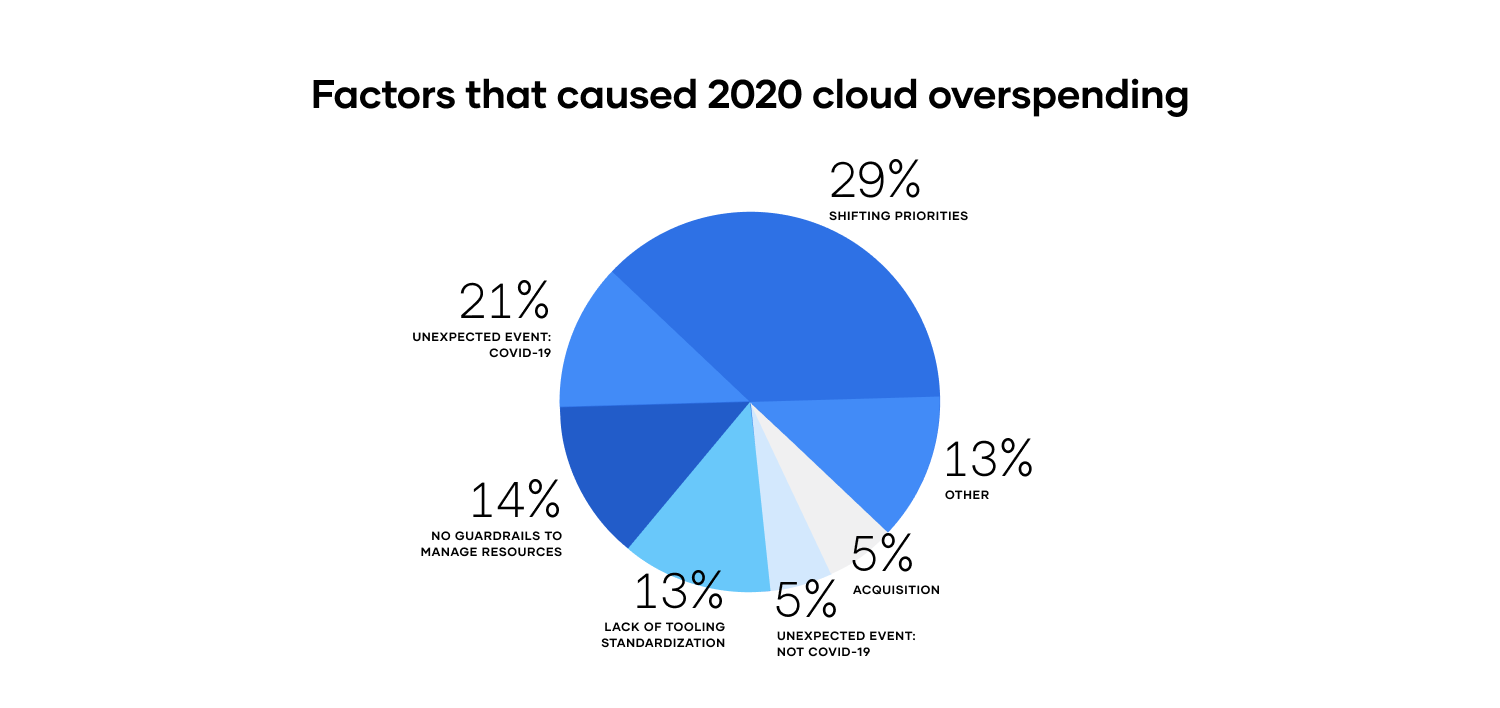

The survey also revealed the complexity of tracking and controlling cloud spending, as 39% of respondents said their organization overspent their cloud budgets in 2020. But contrary to conventional wisdom, COVID-19 was not the primary driver of the busted cloud budgets — the biggest reason was shifting priorities. Ironically, perhaps, the bigger the organization's cloud budget, the more likely the company was to overspend.

We get a clearer picture by using the survey results to follow the money...

»How Much Are Companies Actually Spending on Cloud?

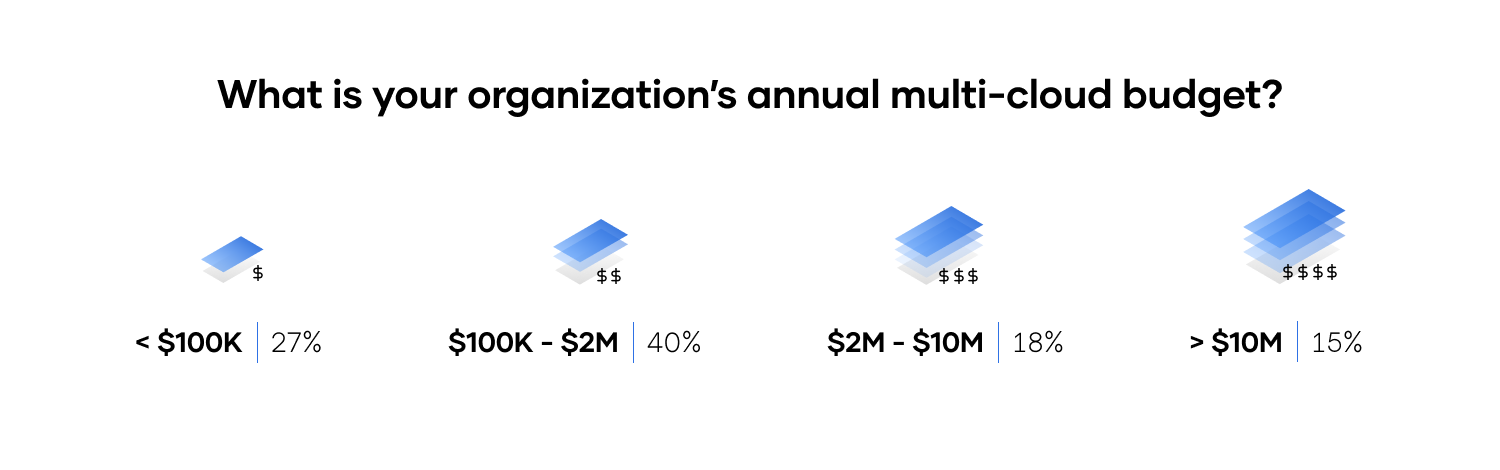

Of respondents adopting multi-cloud, more than a quarter (27%) are budgeting less than $100,000 on their efforts, while almost a third (33%) plan to spend more than $2 million a year. Almost half of those (15% total) budget more than $10 million a year for multi-cloud initiatives, and 6% expect to spend more than $50 million annually.

Given the vast range of spending among the more than 3,200 respondents to our survey, however, we need to look closer to fully understand cloud spending. It stands to reason that cloud investment varies with company size — bigger companies simply have more money to spend — and the survey bore out that notion. Some 62% of small businesses budgeted less than $100,000, compared to a paltry 7% of large enterprises. At the other end of the spectrum, 34% of large enterprises budget at least $10 million a year for their cloud initiatives (as do 1% of small businesses).

It’s far more revealing to break down cloud spending by other factors. Looked at by industry, for example, software and services companies said they keep tighter reins on their cloud budget, with 33% spending less than $100,000 a year. That may not be as surprising as it sounds, though, as this still may represent significant spend for startups and smaller organizations. On the high end, telcos (27%) had the most big cloud spenders investing more than $10 million a year. That makes sense, since telcos tend to be large, well-capitalized organizations deeply familiar with massive infrastructure investments. Other industries with high concentrations of respondents budgeting more than $10 million a year include consumer/retail (22%), and entertainment/media companies (21%).

Regionally, North American organizations are relatively big cloud spenders — 40% of respondents spend more than $2 million a year and 18% spend more than $10 million per year. But Latin America (37%), Europe (32%), and Asia-Pacific (30%) recorded more respondents who budget less than $100,000 a year on cloud.

»Cloud Cost Is a Double-Edged Sword

More than half of survey respondents (51%) cited cost concerns as a primary cloud inhibitor. But it’s not that simple. When asked about multi-cloud drivers, more than a quarter (28%) of respondents cited potential cost savings.

Cloud cost sensitivity varied significantly by industry, region, and company size, not always in expected ways. Cost was a top-three cloud inhibitor for only 42% of financial services companies, which makes sense for these highly capitalized organizations. But cost was a top issue for 60% of notoriously free-spending entertainment/media firms. The public sector was actually slightly lower than overall average, with 47% citing cloud costs as an inhibitor.

Regionally, Latin America was particularly cost conscious (59%). As you might expect, small businesses were disproportionately concerned about cost (58%), while only 45% of large enterprises saw cost as a key issue. But contrary to conventional wisdom, cost concerns were important to a higher percentage of practitioners (53%) than decision makers (50%).

»Is Cloud Spending Under Control?

Clearly, cloud and multi-cloud costs are a big issue for many organizations. One concern is that tracking and controlling cloud spending can be almost as complex as the technology itself. That has led many companies to “waste” an estimated 20% or more of their cloud spend.

Many organizations seem to be adopting the cloud on an ad hoc basis, without a complete multi-cloud strategy or toolset. That approach makes it difficult to project cloud spend, so while almost half (49%) said their 2020 cloud spending fell within their budget, 39% of respondents said their organization overspent on the cloud and another 12% of organizations spent less than projected. Somehow, the bigger the organization's cloud budget, the more likely the company was to overspend: Almost half (46%) of companies budgeting $2 million - $10 million on cloud overspent, compared to just a quarter (27%) of companies budgeting less than $100,000. Cloud spending alignment did not vary much with company size. Notably, however, some ⅔ of the overspenders said they expected to bust their budgets.

It would be easy to blame the COVID-19 for this overspending, but only 21% of respondents blamed the pandemic, a number easily topped by more traditional factors like shifting priorities (29%). For more than a quarter of organizations, cloud overspending was due to a combination of the lack of guardrails to efficiently manage resource utilization (14%) and lack of standardized tooling (13%).

Finally, overspending on cloud was most rampant in North America (42%). Telcos (49%) and financial firms (46%) overspent more than other industries, while software companies (35%) and the public sector (36%) reported the least overspending.

Fortunately, much of this cloud overspending can be avoided by taking steps to minimize cloud waste. There may not be much companies can do about a global pandemic and the rapidly changing business environment, but there are ways for enterprises to reduce overprovisioning and avoid paying for idle and orphaned resources.

Efforts to automate, standardize, and govern infrastructure provisioning can provide greater visibility into infrastructure operations and make it easier to confidently predict cloud spending as well as help minimize actual cloud costs. The impact on developer productivity can be lessened by establishing organization-wide, multi-cloud oriented processes and controls as well as investing in standardized tooling.

»Learn More

To learn more about how companies are investing in cloud and multi-cloud environments, check out the full HashiCorp State of Cloud Strategy Survey. In addition, the HashiCorp Sentinel framework is designed to help organizations provide guardrails around infrastructure provisioning and its related costs.

Related posts